🔩 10-AI-Powered Document Intake

Turning messy PDFs, screenshots, and spreadsheets into structured, auditable data — in seconds.

✍️ Written from Riyadh — for founders, product teams, and AI builders in regulated markets.

🎧 Listen to this Article

📂 From Raw Docs to Insights

Why the hardest part of lending AI isn’t scoring — it’s document chaos.

Walk into any credit team and you’ll see the real bottleneck:

Borrower uploads a hodge-podge of PDFs, JPEGs, and Excel files.

Someone downloads them, renames them, and drags them into folders.

Another person re-types numbers into a spreadsheet “just to be safe.”

Weeks later, underwriting finally gets “clean” data — that might still be wrong.

We built Qararak’s Document Intake Engine to kill that workflow.

🏗️ 1. Ingestion Pipeline Built for Real-World Mess

Accepted formats: PDFs, images, zip bundles, E-statements, even WhatsApp screenshots.

Upload channels: Web portal, API, SFTP, mobile capture.

Every file is stamped, versioned, and sent straight to an on-prem object store — no local downloads, no email chains.

🧠 2. AI-Driven Classification (Multilingual & Domain-Specific)

Standard OCR alone isn’t enough, especially when documents mix Arabic and English.

We combine:

Tesseract + EasyOCR for baseline extraction

LLM-powered layout parsing to detect tables, stamps, and handwritten notes

Custom CNN classifier trained on 40+ Saudi financial templates (bank statements, ZATCA tax returns, MOF certificates)

Outcome: “This is a 2023 audited balance sheet (Arabic), 6 pages.” — with 98 % precision.

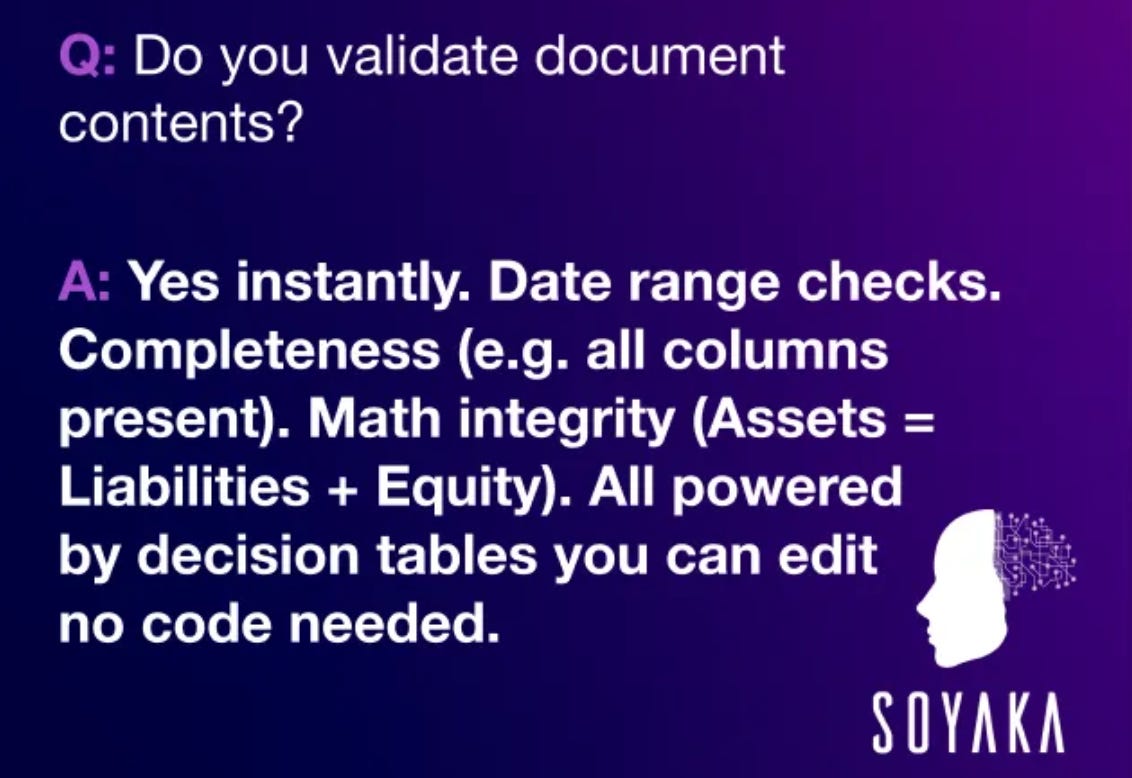

📊 3. Smart Validation Rules — Not Manual Checklists

Once a doc type is confirmed, we fire validation rules in real time:

Example Rule Logic Result Date range check Transaction dates within last 12 m? ✅ / ❌ Completeness All mandatory columns present? ✅ / ❌ Math integrity Assets = Liabilities + Equity? ✅ / ❌

Rules are decision-table driven — business users can add or edit without code.

🔁 4. Feedback Loop to the Borrower (or RM)

If a document fails validation:

Qararak generates a reason code (“Missing VAT certificate”).

Sends an API callback / email template.

Borrower re-uploads only what’s missing.

No phone calls. No guesswork.

🔐 5. Compliance & Audit Trail

SHA-256 hash stored for every file version.

Linked to the borrower’s master record.

Full changelog: who viewed, validated, or rejected a doc — and why.

All data stays on-prem (PDPL-aligned), with optional encryption at rest.

⚡ 6. What This Unlocks

Pain Point Yesterday With Qararak Today Manual renaming & sorting Auto-classification & routing Spreadsheet re-typing Structured JSON payloads Version confusion Immutable hash & timestamp Week-long doc QA Sub-minute AI validation

Speed goes up, errors go down — and underwriting finally gets clean, trusted data.

🧭 Final Thought

Great credit decisions start long before a model runs.

They start the moment a borrower drags a PDF into your portal.

By turning raw documents into validated, structured insights — instantly and securely — Qararak frees your team to focus on what matters: risk, not re-typing.

Next Article

🔩 How We Build AI Differently | Build on Top of Us: Extending Qararak via APIs

🎧 Explore More

→ Listen to the 🤖AI on the Ground Podcast: Real-world AI powering compliance, credit, and regulated markets in Saudi — decoded for operators.